In the post-subsidy and post-epidemic era, China's lithium battery material field is facing new opportunities and challenges.

On the one hand, the increasing market concentration of power battery leads to great changes in the upstream and downstream of the industrial chain, and the strategic cooperation between head lithium battery material enterprises and head battery enterprises is further deepened, thus driving the market concentration of lithium battery materials to increase.

At the same time, the need of energy density and safety performance improvement of power battery is also pushing the positive pole, negative pole, diaphragm, electrolyte and other materials to carry out technical upgrading.

On the other hand, with the rise of China's lithium battery industry chain, China's lithium battery material enterprises have begun to play a more important role in the international market and are facing multiple challenges while obtaining good development opportunities.

Relying on the advantages of product technology and scale, a batch of domestic excellent material enterprises have entered the supply chain of international battery giants, and even set up factories overseas with the leading enterprises, constantly enhance its influence in the international market.

At the same time, with the intensification of market competition, a large number of second-and third-tier lithium battery material enterprises are facing pressure and challenges such as sharp shrink of revenue orders, sharp decline of gross profit and net profit of products, etc. How to choose products, markets, customers become an important topic for their continued survival.

The market share of head material enterprises continues to increase

Relying on the advantages of product quality, capacity scale and customer resource, mainstream lithium battery material enterprises gradually grasp the market discourse power, and the survival pressure of second-and third-tier material enterprises is increasing.

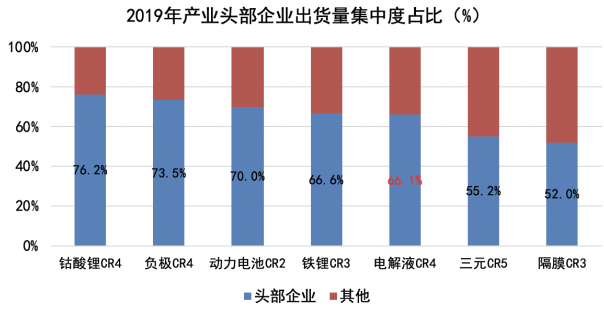

Driven by the growth of power battery shipments, the shipments of four major lithium battery materials in China increased simultaneously in 2019, but the market was mainly concentrated in several top enterprises.

From the perspective of battery end, the statistical data of high-tech Industry Research Institute (GGII) shows that the installed capacity of domestic power batteries in 2019 is about 62.38GWh, with a year-on-year growth of 9%.

Among them, the total installed capacity of the top 10 enterprises reached 54.88GWh, accounting for 87.98% of the total installed capacity, up 5.16% from last year's top 10 enterprises. The total proportion of the top two enterprises is 70%.

Affected by this, the lithium battery material market is also moving closer to the head Enterprises, keeping in line with the development trend of the power battery market.

Specifically, in 2019, the market share of the top 10 enterprises of domestic positive electrode materials was 56%; The market share of the top 5 enterprises of negative electrode materials was 78.9%; The market share of the top 5 enterprises of diaphragm was 67.5%; the market share of the top 5 enterprises with electrolyte is 70.3%.

Obviously, with the intensification of market competition, the market concentration of subdivision material enterprises will be further improved, and enterprises with product quality advantages and capacity scale effects will gain more market shares.

On the whole, head material enterprises are increasing production capacity, increasing research and development investment, improving product technical performance and enhancing internal comprehensive management to further reduce costs and widen the gap with second-and third-tier enterprises. The development trend of the strong in the material industry is becoming more and more obvious.

However, under the new round of industry reshuffle and the pressure of the new Crown epidemic, the elimination of the industry has accelerated, and the second-and third-tier materials enterprises are under obvious pressure, which will face greater survival pressure and challenges in the future.

For example, Lithium Energy, a cathode material Enterprise, was dissolved and liquidated by its parent company hongbaoli due to continuous losses; Many diaphragm enterprises "sold themselves" to continue their lives due to operational difficulties.

Battery performance improvement reverse material technology upgrade

In the final analysis, if new energy vehicles want to compete completely with traditional fuel vehicles, it depends on whether the power battery technology can make a breakthrough.

At present, there are two main ways to improve the performance of power batteries: Optimization of material system and upgrading of manufacturing process.

In the medium and long term, the improvement of power battery performance mainly lies in the upgrading of material system, which further forces technological changes in the field of lithium battery materials.

The key to improving the energy density of the battery lies in the optimization of the positive electrode material system, and at the same time, it will also drive the technical upgrading of the negative electrode, diaphragm and other supporting materials.

At present, the ternary materials are mainly NCM523, but under the requirement of increasing energy density, the ternary materials are developing towards the direction of high nickel, no cobalt or diversification.

At the same time, lithium iron phosphate materials also further improve energy density and safety through doping and coating.

However, in addition to the optimization of the positive electrode material system, performance breakthroughs of negative electrode, electrolyte and other materials are also important factors for improving battery performance.

In addition, the technical upgrading of other lithium battery materials including copper foil, conductive agent, structural parts and so on will also have a positive effect on the improvement of battery performance.

China's power in the international material market

Entering 2020, China, Japan and South Korea battery giants including Samsung SDI, LG chemistry, SKI, Panasonic, Ningde times and so on have obviously accelerated the pace of expanding battery capacity overseas.

Under such circumstances, China's head material enterprises are strengthening the supply chain layout of international mainstream battery customers and playing a greater role in the international market.

With the global battery giant's overseas layout warming up, China's lithium battery material enterprises actively follow up to provide the above-mentioned battery customers with industrial supporting services, while exploring the European market and enhancing international competitiveness.

At present, in addition to the direct supply to Samsung SDI, LG Chemical, SKI, Panasonic and other Japanese and Korean battery enterprises, there are also many Chinese lithium battery material enterprises have announced to build production bases in Europe.

The purpose of the above-mentioned enterprises to build factories overseas is to provide supporting services of the industrial chain for International Battery customers, compete with Japanese and Korean materials enterprises, and enhance market competitiveness.

It is worth noting that compared with Japanese and Korean materials enterprises, Chinese lithium battery materials enterprises face multiple challenges in exporting and building factories overseas.

Specifically, in addition to coping with the strict environmental protection regulations, patent disputes and corporate culture conflicts in Europe, Chinese material enterprises also face the lack of supporting industry chains, fierce market competition, high investment costs, product prices and gross profit continue to decline and other pressures.

Hi-tech lithium battery and hi-tech industry research will hold the 13th hi-tech lithium battery industry summit at Hyatt Hotel Shenzhen Airport from June 10 to 11. The theme of this summit is "market division and industrial fission, from batteries, materials, equipment, more than 500 enterprise executives in each link of the industrial chain such as BMS will jointly conduct in-depth discussions on the trend and reform of the power battery industry in 2020.

At that time, the leading domestic leaders of lithium battery material enterprises will also gather together to "Cobalt-free, Quaternary-power battery material system" side branch blind end "," Silicon carbon negative pole "climbing mountains '", topics such as "The global 'Discourse power' of China's lithium battery materials" were discussed to share the market trend and demand changes of lithium battery materials, and to share the technological upgrading and thinking strategies of enterprises.